In the debate of TradingView vs MetaStock, choosing the right platform can significantly impact your trading success. Both TradingView and MetaStock offer robust features, but they cater to different trading styles and preferences. In this blog post, we’ll explore their key differences and similarities to help you determine which platform best fits your needs. From user interface and charting tools to data coverage and pricing, we’ll provide an in-depth comparison to guide you in making an informed decision.

User Interface and Experience

When comparing TradingView vs MetaStock, one of the most crucial factors to consider is the user interface and experience. Both platforms offer sophisticated tools for traders, but their interfaces and overall user experiences differ in several ways.

TradingView is renowned for its modern, intuitive user interface. It features a clean, minimalist design that focuses on usability. The platform is highly customizable, allowing users to arrange widgets, charts, and tools according to their preferences. This flexibility ensures that traders can tailor their workspace to suit their individual trading styles. TradingView also excels in offering a seamless user experience across devices, with a responsive web interface and mobile apps that maintain functionality and design consistency.

MetaStock, on the other hand, has a more traditional interface that may appeal to users who prefer a classic trading environment. Its layout includes a range of toolbars and menus that provide access to various features and analytical tools. While MetaStock’s interface can initially seem overwhelming due to its extensive range of options, it allows for deep customization, enabling experienced traders to optimize their workspace for efficiency. However, its design can be less intuitive for newcomers compared to TradingView.

In terms of ease of navigation, TradingView’s interface is generally considered more user-friendly. The platform’s emphasis on visual clarity and simplicity helps users quickly access and utilize its features without a steep learning curve. MetaStock’s interface, while powerful, may require a bit more time to master due to its complexity and the density of its tools and options.

Charting Tools and Features

When evaluating TradingView vs MetaStock in terms of charting tools and features, both platforms offer powerful capabilities, but they cater to different preferences and needs.

TradingView is widely acclaimed for its advanced charting tools and user-friendly features. The platform provides an extensive range of chart types, including candlestick, line, and bar charts. Users benefit from a rich library of technical indicators, such as moving averages, RSI, and MACD, which can be easily applied and customized. One of TradingView’s standout features is its scripting language—Pine Script—that allows users to create custom indicators and strategies. This level of flexibility is particularly appealing to traders who wish to build and test unique trading algorithms.

Additionally, TradingView’s charting features include interactive elements like trendlines, annotations, and drawing tools, which are intuitive and easy to use. The platform also supports multi-timeframe analysis, enabling users to view multiple charts simultaneously and analyze trends across different time periods. This can be invaluable for traders who need to monitor various timeframes for better decision-making.

MetaStock, while also offering robust charting capabilities, tends to cater more to traditional and professional traders. Its charts include various types and styles, with an extensive range of technical indicators and drawing tools. MetaStock excels with its integrated technical analysis features, such as expert advisors and trading systems that provide buy and sell signals based on complex algorithms. These features are highly valued by users who prefer a more analytical approach to trading.

MetaStock also offers powerful market scanning tools that can filter and identify trading opportunities based on specific criteria, which can be highly useful for systematic traders. However, its charting interface might not be as visually intuitive as TradingView’s, potentially requiring a steeper learning curve.

Data and Market Coverage

TradingView offers extensive data and market coverage, providing access to a broad range of global markets. The platform includes data for major asset classes such as stocks, forex, cryptocurrencies, commodities, and indices. TradingView sources its data from numerous exchanges worldwide, ensuring that users have access to real-time and historical market data. This wide-ranging coverage is particularly advantageous for traders who operate in multiple markets or seek diversified trading opportunities.

One of TradingView’s key strengths is its real-time data offerings. The platform provides up-to-date market information, which is crucial for making informed trading decisions. Additionally, TradingView supports a variety of data feeds and integrates with several brokerage accounts, allowing for seamless trading and data synchronization.

MetaStock, while also robust in its data offerings, focuses primarily on providing comprehensive data for stocks and commodities. It is known for its detailed historical data and advanced data analysis tools. MetaStock’s market coverage includes major U.S. exchanges and international markets, though it may not be as extensive as TradingView in certain asset classes like cryptocurrencies.

MetaStock excels with its proprietary data services, such as real-time data feeds and extensive historical data, which are particularly valuable for in-depth technical analysis and backtesting trading strategies. However, the platform’s focus on traditional asset classes might limit its appeal for traders interested in newer markets like cryptocurrencies.

Trading and Analysis Tools

When comparing TradingView vs MetaStock in terms of trading and analysis tools, both platforms offer a range of features designed to enhance trading strategies, but they cater to different needs and preferences.

TradingView provides a comprehensive suite of trading and analysis tools that are highly valued for their user-friendly interface and innovative features. The platform includes built-in trading functionalities that allow users to execute trades directly from the chart, which simplifies the trading process. TradingView’s paper trading feature is also beneficial for practicing strategies without financial risk.

For analysis, TradingView offers an extensive collection of technical indicators and drawing tools. Users can access a wide range of pre-built indicators or create custom ones using Pine Script, TradingView’s scripting language. This level of customization is ideal for traders who want to develop and test unique trading strategies. Additionally, TradingView’s strategy tester allows users to backtest their strategies against historical data to assess performance before applying them in live trading.

MetaStock, known for its powerful analytical capabilities, focuses on providing advanced trading and analysis tools. The platform features expert advisors that generate buy and sell signals based on complex algorithms and technical analysis. These expert advisors can help users identify trading opportunities based on predefined criteria, making it a strong choice for systematic traders.

MetaStock’s Market Scanner is another notable tool, allowing users to filter and scan for trading opportunities based on various technical and fundamental criteria. This tool is particularly useful for traders who need to identify potential trades quickly and efficiently. Additionally, MetaStock provides robust backtesting capabilities, enabling users to evaluate trading strategies against historical data with detailed performance metrics.

Pricing and Plans

When evaluating TradingView vs MetaStock, understanding the pricing and plans is crucial for selecting the platform that best fits your budget and trading needs.

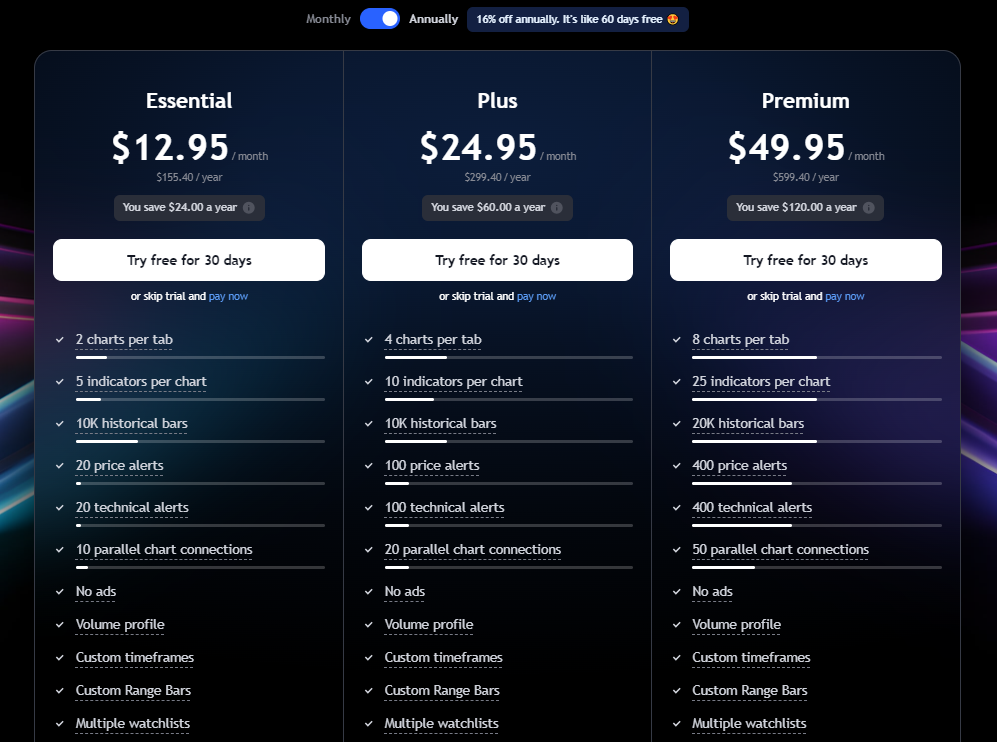

TradingView offers a tiered pricing structure designed to cater to various types of traders. The platform provides a free basic plan that includes essential features such as access to charts, a limited number of indicators, and the ability to save chart layouts. For users seeking more advanced features, TradingView offers several premium plans:

- Essential: This plan provides additional chart layouts, more technical indicators, and faster data updates. It is priced at a moderate level and is suitable for active traders who need more than the basic features.

- Plus: Offering even more advanced functionalities, the plus plan includes unlimited chart layouts, advanced technical indicators, and additional features like ad-free browsing. This plan is ideal for traders who require extensive customization and analytical tools.

- Premium: The highest tier, the Premium plan, provides the most comprehensive set of features, including priority customer support, multiple charts on a single screen, and the most advanced technical analysis tools. It is best suited for professional traders who need the full suite of TradingView’s capabilities.

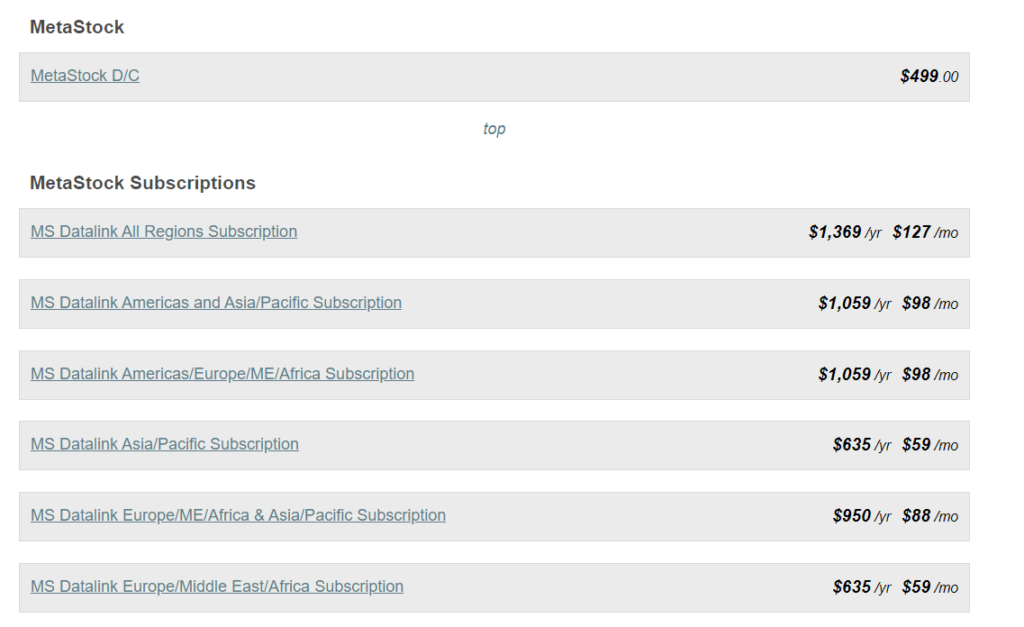

MetaStock also offers a variety of pricing options, focusing primarily on its comprehensive analytical tools and data services. MetaStock provides two main subscription plans:

- End-of-Day: This plan includes access to end-of-day data, charting tools, and MetaStock’s analytical features. It is priced lower than the real-time plan and is suitable for traders who do not require real-time data but still need robust analytical capabilities.

- Real-Time: The Real-Time plan provides access to live market data, advanced charting tools, and MetaStock’s full range of analytical features, including expert advisors and market scanners. This plan is priced higher and is aimed at traders who need up-to-the-minute data and advanced trading tools.

MetaStock also offers additional services such as data feeds and expert advisory tools, which can be purchased separately. These add-ons can enhance the functionality of the base plans but will increase the overall cost.

Integration and Compatibility

When comparing TradingView vs MetaStock, integration and compatibility are key factors to consider, as they determine how well each platform fits into your existing trading setup and workflows.

TradingView is known for its strong integration capabilities and cross-platform compatibility. The platform offers seamless integration with various brokerage accounts, allowing users to execute trades directly from TradingView’s interface. This integration simplifies the trading process and provides a cohesive experience. Additionally, TradingView supports a wide range of third-party apps and services, enhancing its functionality. Users can connect with tools for automated trading, news feeds, and social trading, creating a more comprehensive trading ecosystem.

In terms of compatibility, TradingView is accessible across multiple devices, including web browsers, desktop applications for Windows and macOS, and mobile apps for iOS and Android. This ensures that users can access their charts and trading tools from virtually anywhere, providing flexibility for both on-the-go and at-home trading.

MetaStock also offers integration with various brokerage platforms, though its focus is more on providing advanced analytical tools rather than direct trading execution. MetaStock integrates with several data feeds and external tools, which can be crucial for traders who rely on specialized data sources or additional analytical capabilities.

However, MetaStock’s integration options may be somewhat limited compared to TradingView, particularly in terms of third-party app connectivity and social trading features. The platform is primarily designed for desktop use, with applications available for Windows. While MetaStock offers strong performance on the desktop, its mobile compatibility is not as extensive as TradingView’s, which could be a drawback for traders who require access to their tools on mobile devices.

Community and Support

TradingView is renowned for its vibrant and active user community. The platform features an extensive social network where traders can share ideas, publish trading strategies, and engage in discussions. This community aspect is particularly valuable for users looking to gain insights from other traders and collaborate on market analysis. The TradingView community includes a diverse range of traders, from beginners to professionals, providing a wealth of knowledge and trading perspectives.

In terms of support, TradingView offers a range of resources to assist users. The platform provides a comprehensive Help Center with tutorials, FAQs, and guides covering various features and functionalities. Additionally, TradingView offers email support and an active user forum where users can seek help and share tips. The availability of these resources ensures that users can get assistance and resolve issues efficiently.

MetaStock also provides solid support and community resources, although it operates differently compared to TradingView. MetaStock offers a dedicated customer support team that provides assistance through phone and email. This direct support can be particularly beneficial for users who need personalized help with technical issues or account management.

MetaStock’s community presence is more focused on educational content and professional development. The platform offers webinars, training sessions, and in-depth documentation to help users maximize their use of the software. While MetaStock may not have the same level of social interaction as TradingView, its educational resources are valuable for traders looking to enhance their skills and knowledge.

Performance and Reliability

When assessing TradingView vs MetaStock in terms of performance and reliability, it’s essential to consider how each platform handles data processing, speed, and overall stability.

TradingView is widely praised for its strong performance and reliability. The platform is built on a robust infrastructure that supports real-time data streaming and smooth charting operations. TradingView’s performance is enhanced by its cloud-based architecture, which allows users to access their charts and data from any device without sacrificing speed. This cloud-based model ensures that the platform is generally stable and reliable, even during high-traffic periods.

Users frequently note that TradingView’s charts are responsive and quick to update, which is crucial for real-time trading and analysis. The platform’s uptime is typically high, with minimal disruptions reported. Additionally, TradingView’s scalability ensures that it can handle large volumes of data and multiple simultaneous users without significant slowdowns.

MetaStock, on the other hand, is known for its strong performance in terms of analytical capabilities and data handling. The platform is designed to handle extensive historical data and complex technical analysis without compromising on speed or accuracy. MetaStock’s desktop-based software provides high performance, particularly for users running advanced scans or backtesting large datasets.

However, the performance of MetaStock can be influenced by the user’s hardware and internet connection, as it relies more on local resources compared to TradingView’s cloud-based system. While MetaStock is generally reliable, users might occasionally experience performance issues if their system is not equipped to handle the software’s demands or if they are using large volumes of data

Pros and Cons

TradingView

Pros:

- User-Friendly Interface: TradingView is known for its intuitive, modern interface, which makes it easy for both beginners and experienced traders to navigate and use the platform effectively.

- Advanced Charting Tools: The platform offers a wide range of charting tools, technical indicators, and customization options. Users can create custom indicators with Pine Script and enjoy interactive features like multi-timeframe analysis.

- Community and Social Features: TradingView has a vibrant social community where users can share trading ideas, strategies, and market analysis. This fosters a collaborative environment and provides valuable insights.

- Cross-Platform Compatibility: TradingView is accessible from web browsers, desktop applications, and mobile devices, ensuring a seamless experience across different devices.

- Real-Time Data: The platform provides real-time market data and quick updates, which are essential for active traders.

Cons:

- Pricing: While there is a free plan available, advanced features and tools are only accessible through paid subscriptions, which might be costly for some users.

- Limited Expert Tools: Compared to some competitors, TradingView may offer fewer built-in expert advisors and automated trading tools, which could be a drawback for users seeking these features.

MetaStock

Pros:

- Comprehensive Analytical Tools: MetaStock is known for its powerful analytical tools, including expert advisors and advanced market scanning features. These tools are valuable for systematic trading and in-depth analysis.

- Extensive Data Services: The platform provides robust historical data and detailed analysis capabilities, which are beneficial for traders who rely on extensive data for backtesting and strategy development.

- Strong Performance: MetaStock’s desktop software handles large volumes of data and complex analytical processes efficiently, making it suitable for serious traders.

Cons:

- Steeper Learning Curve: MetaStock’s interface and features may be complex for beginners, requiring a more substantial learning period compared to the more user-friendly TradingView.

- Limited Mobile Compatibility: MetaStock’s mobile access is not as extensive as TradingView’s, which could be a disadvantage for traders who need to access their tools on the go.

- Higher Cost for Full Features: MetaStock’s comprehensive features come at a higher price, especially for real-time data and advanced tools, which may be a significant investment for some users.

Conclusion TradingView vs MetaStock

In the TradingView vs MetaStock comparison, both platforms offer unique strengths tailored to different trading needs. TradingView excels with its intuitive interface, real-time data, and vibrant community, making it an excellent choice for traders who value user-friendly design and collaborative features. Its cloud-based architecture ensures seamless access across devices, and its wide range of charting tools and social features cater to both beginners and experienced traders.

On the other hand, MetaStock shines with its powerful analytical tools, extensive historical data, and comprehensive market scanning capabilities. It is particularly suited for traders who require in-depth technical analysis and sophisticated data handling. While its desktop-based software offers robust performance, it may involve a steeper learning curve and higher costs, particularly for real-time data.

Ultimately, the best choice between TradingView and MetaStock will depend on your individual trading style and priorities. If you seek a modern, flexible platform with strong community support and cross-device accessibility, TradingView may be the right fit. Conversely, if your focus is on advanced analytical tools and extensive data services, and you don’t mind investing in a more complex system, MetaStock could be the better option.

Evaluate your needs, consider the pros and cons, and choose the platform that aligns best with your trading goals and preferences.

- Are you interested in learning a second language online? If so, check out the below link for more information.https://www.rocketlanguages.com/pricing?language=spanish

- To know more regarding ecommerce email marketing tools:https://blog.rxshopbd.com/e-commerce-email-marketing/